Mold is a common problem in homes that can harm your health and damage your property. You might wonder if your home insurance covers mold issues. We’ll look into mold coverage in home insurance. This will help you know what’s included and what to do if you file a mold claim.

Homeowners insurance is meant to protect your home and finances from unexpected events. Most policies cover many risks, but mold coverage can be tricky. Knowing your policy well and what mold is covered can help you make smart choices and stay protected.

Understanding Home Insurance and Mold Coverage

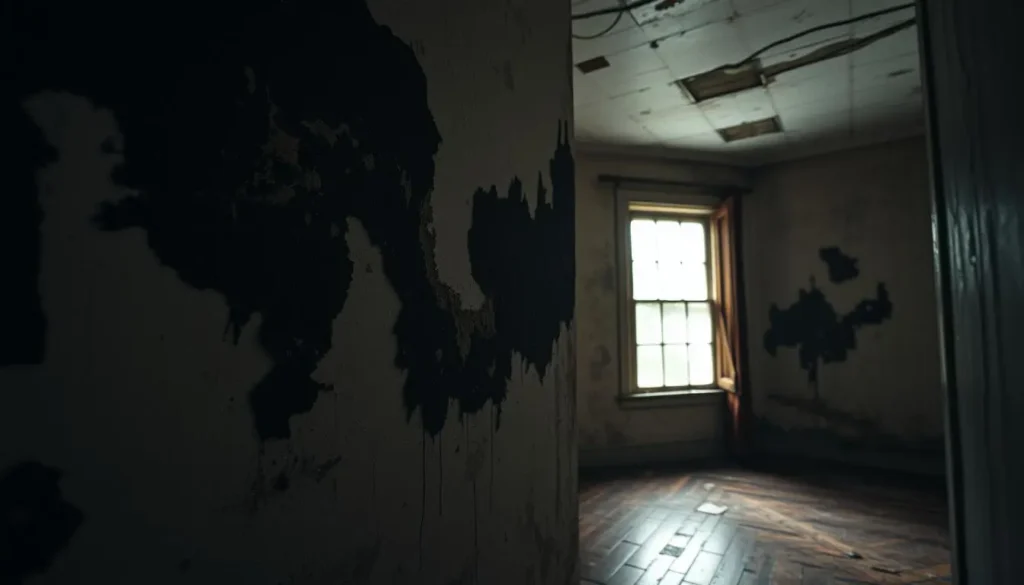

Mold is a common problem in homes that can harm your health. It’s important to know how your home insurance helps with mold issues. Home insurance mold coverage can differ a lot, so let’s explore the basics of mold and how insurance can help.

What is Mold and Its Potential Risks

Mold is a fungus that grows in damp places. It can spread on walls, ceilings, and furniture. Being exposed to mold can cause health problems like breathing issues, allergies, and even brain effects. It’s key to act fast on mold home insurance claims and clean it up to keep your home safe.

The Role of Home Insurance in Mold Remediation

Most mold coverage homeowners insurance policies offer some help for mold damage. This might include the cost of finding and removing mold, and fixing any damaged areas. But, how much help you get can vary, so it’s crucial to check your policy well.

| Coverage Aspect | Details |

|---|---|

| Mold Identification | Many policies will cover the cost of hiring a professional to assess the extent of mold growth and determine the necessary remediation steps. |

| Mold Removal | Policies may cover the cost of safely removing the mold and disposing of any contaminated materials. |

| Structural Repairs | If the mold has caused damage to the home’s structure, such as walls or floors, your home insurance mold remediation coverage may help pay for necessary repairs. |

Knowing your home insurance policy and mold risks helps you deal with mold problems in your home.

Does Home Insurance Cover Mold?

When it comes to home insurance and mold coverage, the answer isn’t always straightforward. The extent to which your policy covers mold damage can vary greatly. This depends on the specific circumstances and the terms of your insurance plan.

Generally, home insurance policies may provide coverage for mold if it is the result of a sudden and accidental event. This includes a burst pipe or a flood. However, if the mold growth is due to long-term neglect or a lack of regular maintenance, your insurer is unlikely to cover the associated costs.

- Many insurers consider mold growth a maintenance issue. Homeowners are expected to take proactive steps to prevent and address it.

- Some policies may provide limited coverage for mold remediation. But with strict limits on the amount they will pay out.

- In some cases, homeowners may need to purchase additional riders or endorsements. This is to ensure comprehensive mold coverage.

It’s important to review your home insurance policy carefully. Understand the specific terms and exclusions related to mold coverage. Consulting with your insurance provider can help you determine the level of protection you have. It can also help you decide if you need to consider additional coverage options.

Remember, being proactive in maintaining your home is key. Addressing any moisture issues promptly can prevent mold growth. This can also help avoid coverage disputes with your insurance company.

Types of Mold Damage Covered by Home Insurance

Home insurance policies cover different types of mold damage. The extent of coverage varies a lot. Not all mold damage is covered equally.

Sudden and Accidental Mold Growth

Insurance coverage for mold depends on how the mold grew. If mold grew from a sudden water leak, like a burst pipe, insurance might help. This is because such events are usually covered by most policies.

Your insurance could pay for mold removal and repairs. This is true if the water damage was sudden and accidental. It’s a key factor in getting insurance help.

| Covered Mold Damage | Exclusions |

|---|---|

| Mold caused by sudden and accidental water events, such as plumbing leaks or burst pipes | Mold caused by long-term exposure to moisture or high humidity levels |

| Mold that results from a covered water damage claim | Mold that is a result of the homeowner’s negligence or lack of maintenance |

| Mold that is discovered and addressed promptly | Mold that has been present for an extended period of time |

It’s key to check your insurance policy for mold coverage details. Coverage can differ a lot between policies. Make sure you know what your home insurance covers for mold and home insurance coverage for mold damage.

Exclusions and Limitations of Mold Coverage

Home insurance policies often cover mold damage, but there are exclusions and limits. These can affect a homeowner’s ability to get a mold remediation claim approved.

One big exclusion is pre-existing mold condition. If mold was there before the policy started, the claim might be denied. Mold caused by homeowner negligence is also not covered.

- Exclusions for mold caused by home renovations or construction work

- Limitations on the amount of coverage for mold-related damages, often capping the payout

- Exclusions for mold resulting from flooding or other natural disasters, which may require separate flood insurance

Some policies have sublimits or sub-caps for mold claims. This means the coverage for mold is capped, no matter the cost of fixing it.

“Homeowners need to be proactive in understanding the nuances of their home insurance policy when it comes to mold coverage. Carefully reviewing the policy details can help them avoid unpleasant surprises during a mold-related claim.”

To get the best protection, homeowners should review their policy closely. They should also talk to their provider about home insurance mold exclusions and home insurance mold limitations.

Preventive Measures for Mold Growth

Stopping mold growth is key for homeowners. It helps avoid costly fixes and insurance issues. Simple steps can keep your home safe and healthy.

Maintaining Proper Ventilation and Humidity Levels

Good air flow and humidity control fight mold growth. Make sure bathrooms and kitchens have fans or windows. This helps air move and keeps humidity low.

Keep your home’s humidity between 30-50%. This makes it hard for mold to grow.

Regular Home Inspections and Maintenance

Check your home for mold growth often. Look at your attic, basement, and other damp spots. Find any mold, leaks, or high moisture.

Fix any problems you find quickly. This stops mold growth and keeps your home healthy.

| Preventive Measure | Benefits |

|---|---|

| Proper Ventilation | Reduces excess humidity and creates an unfavorable environment for mold growth |

| Humidity Control | Maintains optimal humidity levels (30-50%) to prevent mold proliferation |

| Regular Inspections | Allows for early detection and prompt resolution of mold-related issues |

| Proactive Maintenance | Addresses underlying problems, such as leaks, to prevent mold growth in the long run |

By taking these steps, homeowners can stop mold growth. They keep their homes safe and healthy. This protects their investment and ensures a safe living space.

Filing a Mold Claim with Your Home Insurance Provider

If you find mold in your home and think it might be covered by your insurance, it’s key to know how to file a mold claim. The home insurance mold claim process can differ, but there are some basic steps to follow.

First, carefully read your insurance policy to understand what’s covered for mold damage. Some policies might exclude or limit mold coverage, so it’s important to know the details.

After checking your policy and finding it covers mold, document the issue well. Take clear photos of the moldy areas and write down any mold or water damage you see. This evidence is crucial for your filing mold claim home insurance and helps the claims process go smoothly.

- Call your insurance provider right away to start the claim. Be ready to give them the important details, like when you found the mold and where it is.

- Your insurance might ask for a professional mold inspection. This helps them figure out how bad the damage is and what to do next.

- Work closely with your insurance provider during the claims process. This might mean giving them more information or letting them inspect your home.

- Be ready to work with a remediation contractor your insurance approves to fix the mold. They will take care of cleaning and restoring your home.

The home insurance mold claim process can be complex, so staying active and talking openly with your insurance provider is key. By following these steps, you can boost your chances of a successful filing mold claim home insurance and get your home fixed right.

Conclusion

Getting mold damage covered by home insurance coverage for mold can be tricky. It depends on the home insurance mold policy and the situation. Homeowners need to know what their insurance covers, take steps to stop mold, and know how to file a claim if needed.

Being informed and taking action can protect a home and its owner’s finances from mold problems. Keeping an eye on the home, doing regular maintenance, and working with insurance companies helps. This way, homeowners can handle mold coverage details and stay safe from mold damage.

Knowing about home insurance coverage for mold and taking steps to prevent it can help homeowners. It helps protect their biggest asset – their home. This way, they can avoid the financial and risk problems that mold can cause.

For more information on home insurance, feel free to check out the offerings at Insurance Trusty for fabulous resources!